The internet is a wonderful but sometimes scary place to be. Many of us are at greater risk online than we truly realize.

Scammers, fraudsters, and hackers prowl the internet looking for easy targets. And they’re clever. Whether it’s through click-bait emails, fake dating profiles, or a too-good-to-be-true giveaway, there are plenty of ways scammers can find you.

Scams are dangerous and can lead to severe consequences, such as identity or monetary theft and blackmailing. All of us are at risk, but some groups are more likely to be targeted than others – especially the LGBTQ+ community.

In this article, we’ve summarized all of the LGBTQ+-targeted online scams you need to be aware of. Here are the easy and tricky signs to watch out for — and how to protect yourself.

An Easy Target for Scammers

True, we’re all vulnerable online. No one is safe from online scams, but why are some groups easier to target than others?

Certain communities with sensitive or hidden identities are particularly vulnerable, whether related to sexuality, race, gender, or even religion. Scammers latch onto this information and lure you in by pretending to share the same views or having the same orientation.

Once they build your trust, they’ll encourage you to share personal information, like sexual images and videos, bank details, your address, or something else. While it might seem innocent at first, it’s anything but.

Scammers will exploit this information in return for monetary gain or control. They use tactics and threats such as online harassment, blackmailing, and revenge porn to pressure you into doing anything they say to save yourself from embarrassment and exposure.

Online scams can occur anywhere online, so you always have to be aware of the websites you’re visiting and the emails that land in your mailbox. But dating apps and social media sites are the most common platforms for harassment and online scams, as this is where people tend to be more open about their identity and orientation.

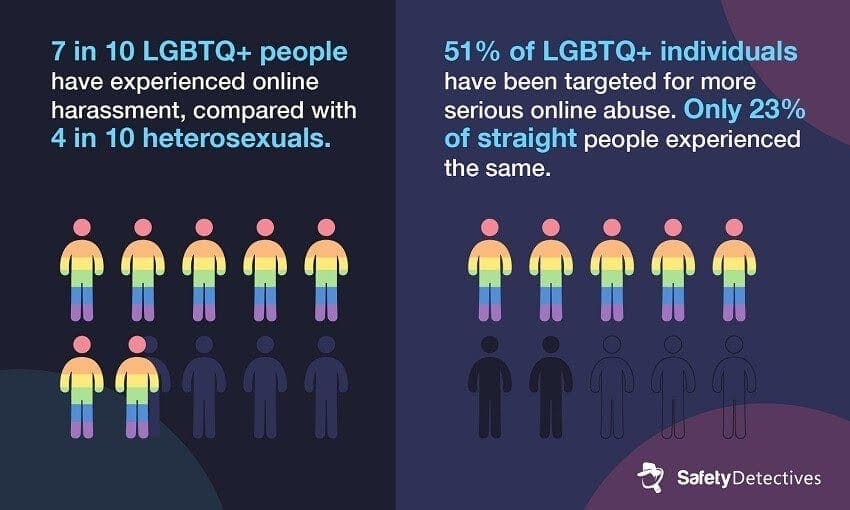

For the LGBTQ+ community, the risks of online harassment are much higher too. In fact, around 7 out of 10 LGBTQ+ people are the target of online harassment. For heterosexual people, this figure drops to 4 in 10. That’s nearly half.

Although online harassment from scams is rife, many choose not to report incidents for fear of them getting worse or being embarrassed. In one survey, only 29% of people said they are fully aware of how and where to report online harassment.

Even more worryingly, some people believe the internet isn’t real life, so they don’t actually think online harassment is a problem in many cases. Although it’s not happening in the physical sense, it doesn’t make it any less serious. In fact, exposure online makes you even more vulnerable to a broader group of individuals who can access your personal details and data any time they like.

Scams Among LGBTQ+ Communities

Finding a romantic match has never been easier with the wide choice of dating apps currently available. But these apps are hotspots for scammers looking to connect with you and offer false promises.

One LGBTQ+ app in particular recently fell vulnerable to online scams through phishing attempts. Scammers set up fake profiles to steal money from Grindr individuals by offering fraudulent or non-existent services.

Romance and dating crimes are pervasive among scammers. These scams are an easy way to manipulate you emotionally and persuade you into handing over money and your freedom to someone else. But there are many other online scams to be aware of, too.

Besides phishing, scammers use all sorts of cybercrime tactics to trap you. There are many ways to hook you in, from text messages and fraudulent voice calls to online ads and targeted direct messages.

Once they’ve got you under their scammer spell, you’re at risk of identity and cash theft, personal data breaches, fraud, and extortion, to name a few. Last year, Americans lost a total of US $1.64 billion in cybercrime alone by falling victim to scammers’ tricks.

Dating Scams

Scammers prowl dating apps looking for easy targets, hidden behind fake profiles with false information and pictures. And fake profiles on dating apps are surging. In fact, around 56% of people on online dating apps have found a profile to be false or misleading.

The people behind these profiles look to build emotional connections with you by offering a false sense of security. Usually, they pretend to share the same views, interests, and sexual orientation as yourself, so that you become emotionally attached.

Once they’ve got you hooked, scammers persuade you to do things for them, whether that’s sending sexually explicit images or videos, or sending them money and gifts.

Scammers are very clever and manipulative, and typically encourage you to send money through irreversible money transfers. This might include gift cards, handing over your PIN, or sending cash directly through WIRE transfer.

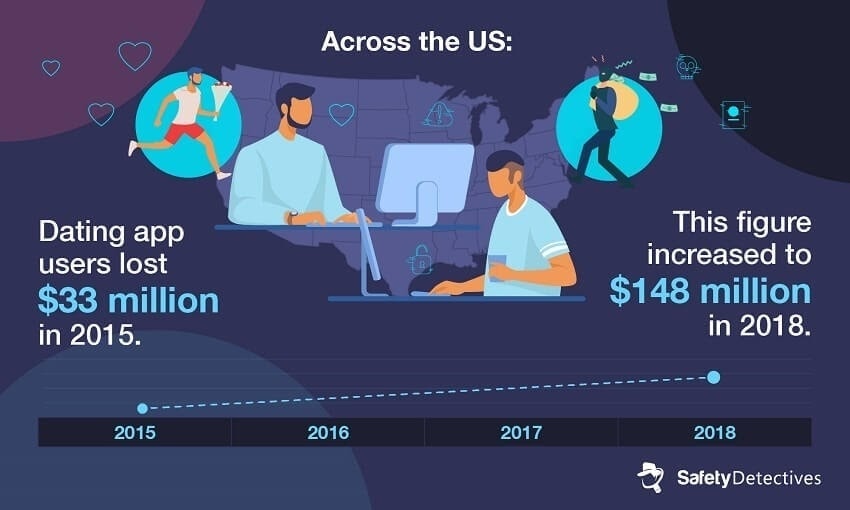

In 2015 across the US, dating app users lost around $33 million to romance scammers alone. This has increased rapidly over recent years, too. In 2018, this figure rose to a total monetary loss of $148 million. Scammers are only getting better, and we’re falling victim to their traps.

Romance scams take many forms and aren’t always easy to spot. It really does pay to be aware of the different dating scams out there, so here are some of the most common ones to keep an eye out for.

Sugar Daddy/Momma

Sugar daddy/momma scams are typically targeted at younger people. The scammer usually poses as someone over the age of 50 and preys on younger individuals, giving them money and gifts in return for sexual favors, both online and offline.

Victims are encouraged to hand over their cash, too. Often, this is in the form of prepaid gift cards. The sugar daddy/momma persuades you into loading your money onto these gift cards and sending it over to them to activate it, with the promise of all your cash back later through a cheque in the mail. Of course, the cheque never arrives.

Underage Profiles

Just as scammers pretend to be someone older, they can also pose as a much younger individual. Usually, the scammer makes a fake profile of someone between 18-21 and reaches out to much older individuals to find a potential sugar daddy/momma.

They quickly build a relationship with you and encourage you to send sexual images, videos, and explicit text messages or phone calls. Once they have this sensitive information, they’ll disclose that they’re much younger than you first thought. And then, they’ll threaten to expose you if you don’t do what they say.

Underage tactics are scary and have many legal issues associated with them, particularly if the scammer does go ahead and report you to the relevant authorities.

Birthday Gifts

A common tactic used by scammers is asking for birthday gifts. They might talk to you for a few days or weeks to establish a relationship with you, before pretending it’s their birthday and explaining how they don’t have any presents.

They then persuade you into sending them money for a false occasion or buying them a gift. Either way, it’s a simple and easy way to get you to hand over your hard-earned cash.

Staying Safe on Dating Sites

Once emotions are involved, it can be hard to let go, even if it is a false reality. Knowing a scam when you see one is essential — not just to protect yourself but your money too.

Some of the most common signs of a romance scammer include:

- They shower you with love and affection almost immediately

- They ask lots of questions about you, but don’t talk about themselves much

- They ask to communicate with you off the dating app, through instant messaging or text

- They avoid video chat and calls

- The pictures they send you look too good to be true, with supermodel-like features or professional photos

- They ask you to send them money

Keep yourself safe on online dating apps with these quick tips:

- Don’t share personal details, including your address, phone number, or bank details

- Consider using a different email address to protect your identity

- Don’t hand over money for anything (whether that’s a birthday gift, a charity, or something else)

- Beware of moving too fast or early declarations of love

- Report a fake profile when you see one to stop scammers in their tracks

Phishing Email Scams

Phishing emails are one of the oldest tricks in the book. Scammers will try everything — and we mean, everything — to get you to open an email, click a link, and hand over your details. As with most online scams, the aim is to steal your details and money.

Scammers pretend to be reputable organizations such as your bank provider, a shopping site, a charitable organization, or someone else you would trust. This is an easy way to get you to open the email.

Most of the time, there’s a link in these emails that you need to click on to hand over some personal details on a separate phishing site. Clicking on these links can also automatically download malware onto your device so that a hacker or scammer can get access.

The number of phishing sites hit a record high in the first quarter of 2021, with over 630,000 known phishing sites across the globe. At the end of 2020, this figure sat at around 140,000. While phishing is an old tactic, it’s increasing.

Although all industries are vulnerable to phishing, banks are the most targeted. If you see a suspicious-looking email from your bank, don’t open it. Even if you do and it looks legitimate, always be vigilant. Usually, a quick call to your bank reveals that they aren’t the sender of the email, and you can save yourself from falling victim to fraud.

Many scammers have moved onto other online websites, such as streaming platforms. They send you an email to explain that your account has been suspended, and you need to re-enter your bank details to reactivate it. Your account is, in fact, working just fine, but now the scammer has access to your money.

In the LGBTQ+ community, one of the most well-known phishing emails is for an LGBTQ+ crowd funder organization.

The email explains how funders provide them with a grant to support LGBTQ+ activist issues, before asking for your bank details to support the cause. Your money actually just goes in the scammer’s pocket.

How to Spot a Phishing Email

While phishing emails can be easy to spot in most cases, scammers are getting better and better at posing as reputable organizations. And they know how to con you with click-bait information.

So, what do you need to look out for?

Phishing emails have tell-tale signs that make them easy to identify. While an email might look like it’s from your LGBTQ+ union, check the sender’s address: a suspicious, personal email means it’s a phishing attempt.

Since they try to mimic organizations, scammers often try too hard to appear professional. They use vocabulary such as “official” and “reputable” throughout, though you often wouldn’t see these on an email if they were from a trusted organization.

Suspicious links that ask for your personal details or appear to rush you into handing over sensitive information are a huge giveaway too. Remember that organizations will never ask you to hand over personal details via email.

Although they look professional, phishing emails are often littered with poor grammar, spelling mistakes, and incorrect word choices. They also might just look a little “off,” such as no paragraphs, blurred images, or different font colors.

Spear Phishing

Spear phishing is another type of fraudulent email, but it’s very targeted.

General phishing emails are sent to any member of the public in the hope that someone will click the link, open the attachment, or send over the personal details the scammer wants. But spear phishing is a little different.

Scammers typically know a lot about you already and use this information to hook you in with a highly personalized email. It might be based on your recent purchases, for example, or a page you follow on social media, or information about where you live. They’ll ask for more details from you with a very convincing message.

Text Message & Phone Call Scams

SMS and phone call scams are very similar to phishing, and are usually referred to as smishing or vishing. They follow the same tactics as phishing emails, with someone pretending to be from an official organization and encouraging you to hand over your details.

Smishing

Smishing refers to fake text messages sent directly to your cell phone. Clever “smishers” send texts from trusted recipients — such as your bank or an online retailer — and they can be very convincing.

One of the most common text scams involves a fake delivery service explaining how they couldn’t deliver your parcel and asking you to click the link to rearrange your delivery. Or, that a small fee is needed to receive your parcel.

When you click the link, you’re taken to a fraudulent website that asks you to input your payment information. In other words, hand over your bank details directly to a scammer.

Just last year, around 3 in 5 people said they’d received a scam text message from a delivery service, particularly because of the pandemic and the number of people ordering goods online.

Vishing

Vishing is another form of phishing used by scammers, and it’s perhaps the scariest of them all.

Scammers call you with an unknown caller ID or a spoofed phone number (a false caller ID), such as an 0800 number, pretending to be a legitimate company. Vishers also “rent” or clone local numbers to get you to pick up the phone.

Some may even ring you and hang up immediately, in the hope you’ll ring back. Once you do, you’re connected to a new local number that incurs hefty charges.

Usually, vishers pretend to be someone calling from your bank, urging you to protect your account by handing over your details. Or, ironically, they might explain how you’ve been a victim of fraud and how they need to move your money to a safe account.

Vishing calls can be compelling and persuasive. It’s not always as easy to detect a false call compared to a fake text or email. Once they’ve hooked you in, not only do they have access to your phone number, but they can also find out all of your personal details, including your address and bank information.

How to Spot a False Text or Call

Spotting a scammer isn’t always easy, but there are key signs that you can look out for when it comes to smishing and vishing.

- False sense of urgency: Whether text or call, scammers often pressure you into taking action immediately as a way of easily getting access to your information.

- Asking for personal details: Fraudsters try to convince you to hand over your PIN codes, bank details, credit card information, address, or even email to get their hands on your details.

- Asking for access to your device: Scammers might try to persuade you into giving them access to your device, such as your phone or computer, where they can then steal your information.

- Suspicious links: Smishing text messages urge you to click a link and provide your details, usually leading you to a fraudulent website where scammers are waiting.

- Unknown caller ID: Vishers might ring you with an unknown caller ID to conceal their identity. If you’re not sure who it is, don’t pick it up.

Protecting Yourself from Smishing and Vishing

You can stop scammers from contacting you by being aware of where you share your details online.

Posting your phone number and email address is risky, especially on LGBTQ+ dating apps and social media sites. Unless absolutely necessary, avoid making your contact details public knowledge. You’re giving scammers the green light.

If you fall victim to smishing and vishing, you can take steps to protect yourself. First of all, immediately block any numbers you don’t recognize that contact you. And don’t call or text back any unknown numbers.

If you’re sent a text message, and a link looks suspicious, it probably is. Don’t click any links you’re unsure of. If you do and you’re taken to a website that asks for your personal details, think twice before handing them over.

Since scammers pretend to be companies you know, like your bank, local delivery service, or favorite online shop, they try to hook you in on the basis that you already trust them. The best way to find out if it’s a scam is to call the organization directly yourself and speak to them. Always double check first.

Remember, it’s not only you that’s vulnerable to online scams. If you see a scam, always report it via the appropriate channels. That way, you can help prevent scammers from reaching out to anyone else.

Social Media Scams

Social media sites help you connect with anyone, from anywhere. Unfortunately, this also includes scammers.

Many scammers prowl your social media platforms looking for ways to manipulate you by learning about your likes, dislikes, online behavior, sexual orientation, and much more.

Although fraudsters look at your social media for other scamming tactics such as phishing, it’s not uncommon to come across an online scam on a social media site itself.

Some of the most common online social media scams include fake celebrity news and online ads that tempt you into looking at who’s viewed your profile. On Facebook, you might also see an ad for the Facebook dislike button. This doesn’t exist, but it’s an easy way to tempt you into clicking a link.

These links take you to a fake website that either asks you to input information or has scammers waiting in the wings to hack your device and steal your details.

You might also come across fake friend requests and followers. Like a dating app scam, these individuals seek to build a relationship with you before persuading you to hand over your money or information.

Protecting Yourself From Social Media Scams

One of the best ways to protect yourself is to set your profile to private. That way, only people you’ve accepted can view your profile. Remember: only accept friend and follower requests from people you know, too.

Avoid posting your personal details online or oversharing information about yourself on social media. Doing so only makes you an easy target for identity theft and other scamming tactics.

Just as with dating apps, be wary of anyone direct messaging you professing their love, asking for gifts, requesting your personal details, or anything else.

Look out for false LGBTQ+ fundraisers, crowdfunding petitions to support the LGBTQ+ community, or fake news about known people in the community (including celebrities). If you see anything suspicious, be sure to report it.

Shopping Site Scams

Anyone who shops online loves to find a bargain, and scammers know this. Fraudsters have gotten clever at creating copycat websites for well-known brands that offer huge discounts and deals. However, you’ll be losing money rather than saving it.

It’s typical for scammers to use phishing tactics, including vishing and smishing, to send you links to what looks like a very genuine website from a retailer you trust. These websites even let you check out and buy an item, though, of course, that item never arrives.

These scams offer high-end, luxury items at a significantly discounted price, which should ring alarm bells right away. They also demand payment via electronic transfer, rather than by card.

Many scammers use subscriptions to keep taking payments off you. They offer a deal for a set fee, but fail to mention that you’ll continue to be charged until you cancel. And they don’t make it easy to cancel either.

You’ll likely lose money from buying an item that never ships, but scammers might also look to steal your personal details and set up other websites in your name. Or make you a victim of identity theft.

How to Spot a Shopping Scam

The first and easiest way to identify a shopping scam is by checking the domain name. Sometimes, the URLs look very similar to the brand’s genuine site. But you can usually spot a scam if the domain name is something suspicious like “www.sneakeroffers.net” when you’re expecting to head to “www.nike.com.”

URLs often also have small spelling mistakes or grammatical errors that you might not be able to spot straight away. For example, it might read “Amaz0n” rather than “Amazon”. Be sure to double check the link before you click it.

Insecure websites won’t include “HTTPS” in the name either. Usually, your web browser will pick up a dubious website, but it’s always a good idea to check the URL anyway.

If the offer is too good to be true, then it probably is. Scammers lure you in with amazing deals, but the brands themselves wouldn’t discount their products by that much. Ridiculously low prices and huge discounts are a red flag.

Check out the payment method, too. If it asks you to pay for items via bank transfer, you know it’s a counterfeit site.

Job Search Scams

The days of printing out and handing in a physical copy of your résumé are a thing of the past. More and more of us are applying for positions online, making us vulnerable to job scams and fraud.

Scammers monitor job application websites and know who’s looking for a new career. If you’re fresh out of college or university, you’re particularly vulnerable, as scammers know you want to enter the world of work. But, honestly, no one is safe.

Once they access your information, they lean on this to target you with emails, letters, or even through vishing. Lots of scams promise high rates for very little work. Even on legitimate job application websites, you can still come across false ads.

Usually, these so-called jobs require little to no qualifications and experience, and come with unusual or added perks. One of the most common perks is working from anywhere you like in the world, including your home, for very few hours.

If you accept the job, you might be asked to pay an upfront fee for materials or starter kits. This is a way to take money from you straight away. And then they’ll refuse to pay you for your hard work.

Even though many of us might know how to detect a suspicious job advert, it doesn’t mean we always avoid them.

Scammers know that we trust job application websites, and that people can often get desperate when they’re starting or changing their career. A survey by Safer Jobs found that 98% of people would still follow through with their application, even if they thought something might be a little off.

Different Types of Job Scams

Job scams are an easy way of getting victims to hand over their money. There are various types of job scams, from making you pay upfront fees to more scary fraud tactics, including money laundering.

Upfront Fees

If you’re asked to pay an upfront fee for a job, it should ring alarm bells. The scammer may say the fee is for equipment, training, or starter kits you need for your new position — but most of the time, you don’t.

For an overseas job, scammers may even ask you to pay immigration fees or travel agent costs.

Money Laundering

Money laundering is undoubtedly one of the most serious job scams out there. Scammers will employ you for what seems like a genuine job, and they will probably pay you the salary they promised, so you don’t suspect anything unusual. In actual fact, they’re using you to launder illegal money.

Some of the biggest tell-tale signs for money laundering include “employers” offering you a guaranteed job with no experience or qualifications needed, plus telling you that you can work from anywhere you like.

Salary Payments

Scammers will ask for your bank details to pay you for your work or set up salary payments, though, in actual fact, they steal money from your account. It can be very difficult to recover your money in these situations too.

Phone Fees

A scammer will arrange a telephone interview with you. Then you’ll incur charges every minute you’re on the phone. They might even put you through several fake interviews to rack up fees. You can be left on hold for a while to add extra charges.

Protecting Your Personal Information

It can be tempting to put everything about yourself on your résumé, but this probably isn’t a good idea. Your future employer wants to know about your skills, qualifications, and experience. The rest, you can probably leave out until a later date, besides your name.

Avoid putting too much personal information on your résumé, such as your address, email address, phone number, and date of birth. Once you’ve uploaded this online, scammers can easily get access to it, putting you at risk of identity theft and fraud.

Some job scams might even ask you for personal information right away in an attempt to steal your identity.

No legitimate job advert will ever ask for your passport number, national insurance details, height, weight, or bank details. And you don’t need to include these on your résumé.

Doxxing

Doxxing involves people digging up documents relating to you online or discovering your identity and personal details (i.e., your home address), then threatening to share that information as a form of harassment or blackmail. Doxxing is highly targeted and can be dangerous.

Vulnerable individuals, especially the LGBTQ+ community, are usually targeted first. Scammers know they can exert power by threatening to expose certain details about you, such as your sexuality or gender.

What Are Doxxers Looking For?

Doxxers want any personal information they can find. This includes:

- Address and places you visit frequently

- Date of birth

- Religious views, gender, and sexual orientation

- Likes, dislikes, and online behaviors

- Daily routine, including your workplace, your travel route, and your gym

- Phone numbers, email address, and bank details

- Personal photographs and videos

- Social media profiles

Finding Your Personal Information

Doxxers use various tactics to dig up your information. It’s actually much easier to find your information than you might think.

Stalking Your Social Media

Usually, the first place scammers look is your social media. They look at what you like, engage with, post about, your photos and videos – basically, anything you share about yourself. That’s why having a private profile is very important.

Scammers learn about your habits, behaviors, likes, and dislikes, and look for ways to blackmail you. They even look at locations you’ve been in.

Digging up Government Records

Studying government records is another way to access your personal information. Doxxers look to find your birth certificate, qualification records, driver’s license, public violations, and any other official information they can get their hands on.

If you’ve purchased a house, doxxers can explore all the documents from the sale and purchase, including how much you bought it for, the location, estimated value, and floor plan.

Packet Sniffing

Doxxers can track your online browsing habits and try to intercept your data. If they’re successful, they can hack your device and uncover all of your personal details.

Some scammers also use IP tracking, which attaches a code to your IP address. Once you visit a website, the scammer is notified. It’s an easy way to keep a watchful eye on what you’re doing online and who you’re engaging with. Any private messages you send, they can get a hold of.

If you use a regular username across different sites, doxxers can track this, too. They can dig up messages on forums, message boards, and social media platforms, even if you think it’s “anonymous.”

Phishing

Doxxers rely on phishing emails with click-bait links to lure you in easily. These links can take you to any kind of fraudulent website, or might even download malware onto your device so that scammers can hack it.

Staying Safe from Doxxing

In some cases, doxxing isn’t illegal, despite how dangerous it can be.

If information about you is public knowledge and can be accessed without any illegal tactics, then there’s no real crime. It doesn’t make it any less damaging to you, though, which is why you should always take precautions to protect yourself.

Rebate Scams

Rebate scams often use phishing, vishing, or smishing tactics to convince you that you’re due a refund or reimbursement from a trusted organization like the taxman.

You’re sent a fraudulent link to a copycat website asking for your personal information and bank details so that you can be sent your rebate. These sites can be very convincing and even have forms that look entirely legitimate.

You may also be asked to send an extra payment to cover administration fees, which is a quick and easy way to take some extra cash from you.

Rebate Scams Warning Signs

Keep yourself safe from rebate scams by knowing what to look out for:

- Someone contacts you out of the blue offering a refund.

- URL looks suspicious or doesn’t include HTTPS.

- You’re asked for payment upfront to cover administration fees.

- Someone tries to convince you to fill out the form urgently.

- The site uses an unusual payment method, such as direct bank transfer.

- You think it could be a phishing, vishing, or smishing attempt.

- The website doesn’t look legitimate.

Prize & Lottery Win Scams

Prize and lottery wins are a clever phishing attempt. Scammers try to persuade you into believing that you’ve won a huge cash prize or gift.

These prize wins might be unexpected, but clever scammers know if you’ve entered yourself into a draw for something — especially if they’re tracking you online. They will try to mimic the organization and convince you that you’re the winner, relying on the fact that you’ll trust them.

As with most phishing attempts, the text or email comes with a suspicious link that takes you to a counterfeit website. Usually, you’re asked to input your details on a form to claim your prize. The real prize is, of course, for the scammer, who now has access to your personal information.

Ironically, you may even be asked to keep your prize win a secret for security reasons, though this is to stop someone close to you from identifying it as a scam.

In some cases, scammers get access to your social media profile and send a message to your close friends and family to explain how they’ve won a prize. The message looks like it comes from you, so the other person is more likely to click on it.

Remember, if your gut is telling you something isn’t right, then it’s probably not. You can bypass scammers by calling the organization directly to check if you are indeed a prize winner. Do not contact them using the details provided by the phishing attempt.

Financial Support Scams

Scammers like to learn whatever they can about you to send you highly targeted scams that can be very convincing. Actually, they appear to be just what you’re looking for. This includes financial support scams.

If you’ve been looking at credit cards or loans online, you can bet a scammer knows about it. They will use this information to send you phishing, smishing, or vishing scams, promising you a low-interest, high-value loan or credit card. Of course, these are not legitimate.

The fraudulent links ask for personal details, including your bank and credit card information. They might even make you pay a fee.

Even if you’ve not been actively searching, if you have the smallest amount of debt, scammers can find out about that too.

Sometimes, scammers try other tactics. They often say how they can work with your creditor to reduce your interest rates and cut down how much you’re paying every month. All they need is a small upfront fee.

Always keep an eye out for fake lenders. If they ask for an upfront fee, no matter why, be sure to question it. Even if the email, text, or call sounds legitimate, contact your creditor or the financial organization they’re pretending to be to double check the information.

If you feel like you’re being pressured or rushed into applying for debt help, it’s usually a scam. Actual lenders might send you emails to encourage you to apply, but they’ll never make you feel forced into doing so.

Investment Scams

Investment scams persuade you into handing over your money by promising you a profitable return. One of the most common is cryptocurrencies, especially Bitcoin investments.

Although the investment does actually exist, the scammer steals your money rather than investing it for you. Since October 2020, Americans have lost over $80 billion in fake cryptocurrency investments alone — a 1,000% increase from the last quarter of 2019.

Scammers can be very calculated and work with you for a long time, showing you false data and figures on how your cryptocurrency shares are growing in profit. All the while, they’re stealing your money. It’s not until you ask for your funds that the scammer disappears.

Cryptocurrencies aren’t the only type of investment scams, however. There are lots of investment scams you should be aware of. Here are some of the most common ones:

Travel Scams

Ticket and travel scams are everywhere. A cybercriminal might use a travel scam as part of a fake prize win, explaining how you’ve won a free holiday. Or they may trap you with fake flight tickets, heavily discounted hotel packages, or really cheap travel insurance deals.

As with most online scams, you’ll usually be targeted for a travel scam if you’ve been searching holiday deals and flights online, as scammers know you’re already interested. They also know you’ll be more likely to click a link whether it looks suspicious or not.

Scammers often pose as well-known airlines or hotels in the hope that you will trust them.

If you accept your travel prize or click on the deal, you may be asked to hand over your credit card details and pay a small administration fee. In actual fact, the scammer just wants access to your bank.

You should also watch out for fake images on social media. Scammers will post a photo of an idyllic-looking location on social media, hoping that you’ll click on it.

These links often lead to a survey, which asks for tons of personal information. Or, the link downloads malicious content onto your device so the scammer can hack it.

If you win a holiday out of the blue, or you think a travel deal could be suspicious, always think twice. Contact the organization the scammer is claiming to be first, to verify the deal or prize.

Be cautious of any forms asking for lots of personal information or payment upfront. Especially if the payment is via check or bank transfer.

Tech Support Scams

Ever had a pop-up on your computer telling you your device is infected and you need to download protection software? That’s probably a tech support scam.

You can fall victim to these scams by visiting unsecured or fraudulent websites, which download certain viruses onto your system without you knowing. These viruses show up as the opposite — persuading you to install antivirus software.

If you install the antivirus software, it usually provides a hacker with full access to your device. That includes all of your personal files, data, images, passwords, and anything else you have saved on there.

Protect yourself from tech support scams by knowing the warning signs. Here are the top three to look out for:

- You receive a prompt asking you to download malware protection.

- You see warnings for viruses on your device through online ads or while browsing the web.

- You receive a vishing phone call from someone pretending to be a tech support agent, telling you your device is infected.

If you do download any antivirus software, make sure it’s from a trusted company. Check out our top 10 recommendations to use across Windows, Mac, iOS, and Android devices.

You can also use a VPN while browsing the web, as this will block any pop-ups or online scam ads that might tempt you into downloading faulty software.

How to Report A Scam

Reporting online scams is absolutely necessary if you want to protect your identity and bank account from fraud.

Tracking down a scammer stops them from finding new targets. So reporting online scams isn’t only important for yourself, but for protecting other people online too.

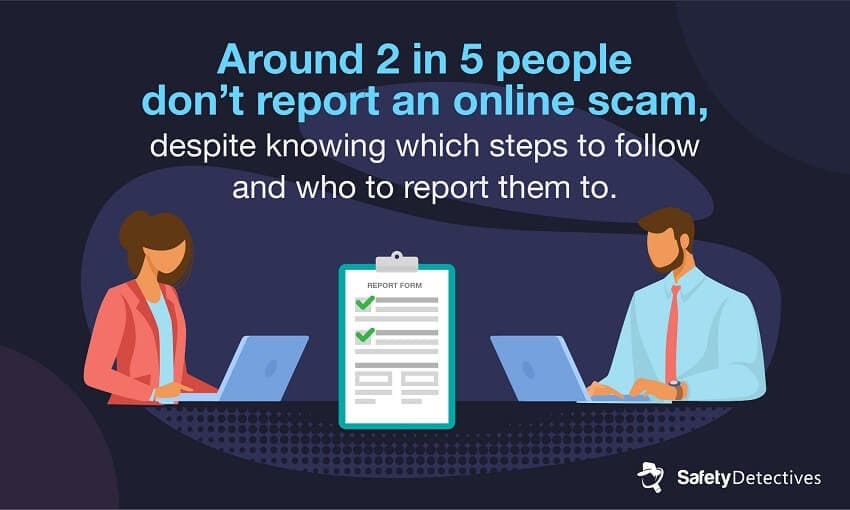

However, it’s not always easy to know how and where to report scams, which leads to many cases going unreported. And while some people do know which channels to go through, many simply choose not to.

Around 2 in 5 people don’t report online scams, particularly ones found through online ads or social media platforms. Time-consuming forms are mostly to blame, though many also believe that the necessary organizations don’t actually take any action against fraudsters.

With scammers getting away with their fraudulent habits, more and more of us are falling victim to their tactics. If you come across a scam, make sure you know how and where to report it.

How you report an online scam often depends on the type of scam it is and where it happened. It also varies from country to country.

There are official anti-fraud organizations in most countries to which you can report any scam — whether it’s a romance scam, phishing email, or vishing call.

Here are the leading organizations you need to know about around the world:

- US: USA Gov

- UK: Action Fraud

- Canada: Canadian Anti-Fraud Centre

- Australia: Scamwatch

- Europe: OLAF

Some sites and services have other reporting channels, particularly on social media and search engines.

While you can report scams on these platforms to the official organizations listed above, it’s a good idea to follow the steps on the actual platform too.

Facebook has a reporting tool that allows you to report any ad you think is suspicious. To use it, just click the “Report” button and choose the reason why you think the ad is inappropriate.

You can also report posts from others and direct messages, using the three dots button. This takes you to a “Find support or report post” page, where you can explain why you’re reporting it and take other actions such as blocking someone.

As well as scams, you can report anything sexually inappropriate, harmful, or misleading too.

On Twitter, use the downwards arrow on a Tweet to report it as a scam. You can select the “it’s suspicious or a scam” option, then choose from the additional options to provide a little more information.

Twitter will usually temporarily suspend an account if fraudulent activity is suspected, or may remove the perpetrator from the platform entirely.

Google has a variety of different methods to report fraud. If you suspect a phishing email, you can use the “More” button from your Gmail inbox to report it as phishing.

For an ad, click the “Why this ad?” button first, then select “Report this ad” to fill out the appropriate form. It can be quite a lengthy process with around 5 steps, but it’s worth it if it stops a scammer.

What to Do if You’ve Been Scammed

If you think you’ve been scammed, you should take steps immediately to protect yourself and contact the relevant organizations.

The Scammer Contacts You

If the scammer sends you an email, text, or tries to call you, keep a record of it and everything that happened so you can use it as evidence. Don’t answer a call if you know it’s a scammer.

Keeping screenshots of emails and text messages is also a good idea.

The Scammer Has Control of Your Device

Scammers may get access to your computer, tablet, or mobile phone. While doing so, they’ve likely snooped on all of your personal information and probably installed malware on your device.

Make sure you change all of your passwords immediately and contact your bank to block your cards. Try to remove any sensitive personal information you have on your device, whether photos, browsing history, saved passwords, or cookies.

You should also update your antivirus software to remove any viruses the scammer has installed.

You’ve Sent the Scammer Money

If you’ve already sent the scammer money, there are steps you can take to recover your cash.

It depends on how you’ve paid the scammer, but you can contact your bank provider to let them know, and they can walk you through the process.

You should also contact the police straight away, as their fraud team will be able to advise you on what to do next and may want more information to help their investigation.

Recovering Your Money

It’s scary that scammers can get access to your bank and steal your funds. And it’s even scarier when they’ve convinced you to pay them yourself, as it often looks like a legitimate payment.

There are ways to get your money back. However, the steps you need to take depend on how the funds were paid — and it’s not always straightforward.

You Paid Cash

Cash is the most difficult type of payment to recover, since there’s no accurate record of it being paid.

The only way to try and recover your funds is to report the fraud to the appropriate organization and to the police. It’s at their discretion as to whether they’re able to reimburse you, which is why paying cash is the most risky. In some countries, such as the UK, the police have returned lost funds to fraud victims.

You Paid Via Bank Transfer

Contact your bank immediately if money has been taken from your account or you paid a scammer via bank transfer.

Usually, you’ll need to speak with the bank’s fraud team and fill out several forms. You will also need to block your card for the relevant account. Once you’ve notified the bank, they will put the money back in your account.

You Paid Using Debit

If your debit card has been used, you’ll need to block your card immediately by contacting your bank.

Your bank should also recover the lost funds once they can identify the unauthorized or fraudulent payment.

You Paid Using Credit

Credit cards have the most fraud protection, making them one of the easier options for getting money back.

Credit cards are typically covered by laws, meaning that you’re entitled to get any money back that was stolen or that you’ve paid for goods and services that never arrived. Usually, this covers anything costing between £100 and £30,000.

Contact your provider as soon as possible to get the credit placed back onto your card.

You Paid Via PayPal

PayPal offers buyer and seller protection, especially if you selected to pay for goods or services when you transferred the funds.

You’ll need to claim in the PayPal Seller Protection area of the site to recover your funds.

However, scammers are clever, and they may set up legitimate-looking PayPal forms that collect your bank details. If this is the case, it’s difficult for PayPal to identify it as a scam, and they might withhold payment.

Keeping Yourself Safe

Scam artists will try everything they can to get you to hand over your details and money. Being aware of what you post and see online is key to preventing crooks and protecting yourself.

Here are our top 10 tips for keeping yourself safe from online scams:

- Protect Your Funds

Never send money to someone you don’t know or pay for goods and services that you haven’t thoroughly researched first.

Think twice before handing over your bank details, especially if someone requests that you pay via direct bank transfer or wire payment.

- Pay with Protection

Give yourself greater protection if anything goes wrong by using payment methods that allow you to recover your funds. Credit cards are usually the best option. Wherever you can, avoid paying with cash.

- Don’t Click Suspicious Links

If you think a link looks suspicious, don’t click it — especially if it’s come through a phishing or smishing attempt.

While the message you receive might look legitimate, always check the link first to see if it matches. And see if it includes ‘HTTPS, so you know it’s secure.

- Don’t Answer Vishing Calls

Be aware of phone calls coming in from unknown caller IDs.

Even if a scammer manages to rent a local number and you pick it up, always question what they tell you on the phone.

If they ask you for personal details like your account number, sort code, and PIN over the phone, don’t hand them over.

- Double Check First

If someone does contact you and you think it might be legitimate, it’s always worth double checking. Scammers often impersonate reputable organizations, which might make it harder for you to decide whether to trust them or not.

Contact the organization yourself first and speak to someone else. They’ll be able to confirm for you whether it’s a scam or not.

- Don’t Overshare Online

Be careful when sharing personal details like your address, email address, phone number, and recent locations online. Doing so only allows scammers to keep track of your whereabouts and find ways of contacting you.

- Check Your Privacy Settings

Keep yourself private online wherever you can, especially on social media. Revise your privacy settings on your social media apps so you can control who looks at your profile.

Be sure to update your passwords regularly and try to use different ones across different platforms. Saving passwords to your browser makes logging in easier, but also gives hackers easy access to your details.

You could use a low-cost password manager to add extra levels of security and keep hackers locked out.

- Avoid Pop Ups & Risky Ads

Keep an eye out for unusual ads while browsing the web, including on social media. If you’re not sure, don’t click it.

Always be aware of risky pop-ups on your device, too. Especially ones that tell you your device is infected with a virus or that you need to update your software.

- Is It Too Good to Be True?

If you see a tempting ad, email, or text that looks too good to be true, it probably is. Scammers love to over-promise because it’s an easy way to lure you in.

Although the email might tell you you’ve won a holiday, the likelihood is you probably haven’t.

- Install Antivirus Software

Help stop scammers from getting control of your device by installing antivirus software.

This software will regularly scan your device for viruses and stop you from visiting any sites it detects as unsecured.

Stay Safe, Keep Scammers Away

Online scams are scary, but they’re very real. It’s so easy to fall into a scammer’s trap, especially when you’re part of a vulnerable group like the LGBTQ+ community.

Scammers look for easy targets and gather information they can lean on to exploit you, blackmail you, or emotionally manipulate you. After all, all they want is your money. And they’ll do anything they can do to get it.

Remember, always think twice when you see anything suspicious. Whether it’s an ad, an unusually-targeted email, a suspicious phone call, or a direct message from a potential romantic interest. Protecting yourself, your identity, and your money is more important than a potential date or a free trip.