Norton LifeLock Review: Quick Expert Summary

Norton LifeLock offers the best identity protection tools on the market — it monitors all of your sensitive information, alerting you to any suspicious activity regarding your bank accounts, personal information, payday loans, and more.

On top of protecting your data, LifeLock gives you comprehensive identity theft coverage. It provides reimbursements for stolen funds, personal expenses while dealing with theft, and the cost of lawyers and legal experts, totaling up to $3 million in coverage.

LifeLock also comes with a suite of excellent features, including:

- Social media monitoring.

- Identity locking.

- Credit monitoring.

- 401k and investment account alerts.

- Lost wallet recovery.

- 24/7 live chat support.

- And more…

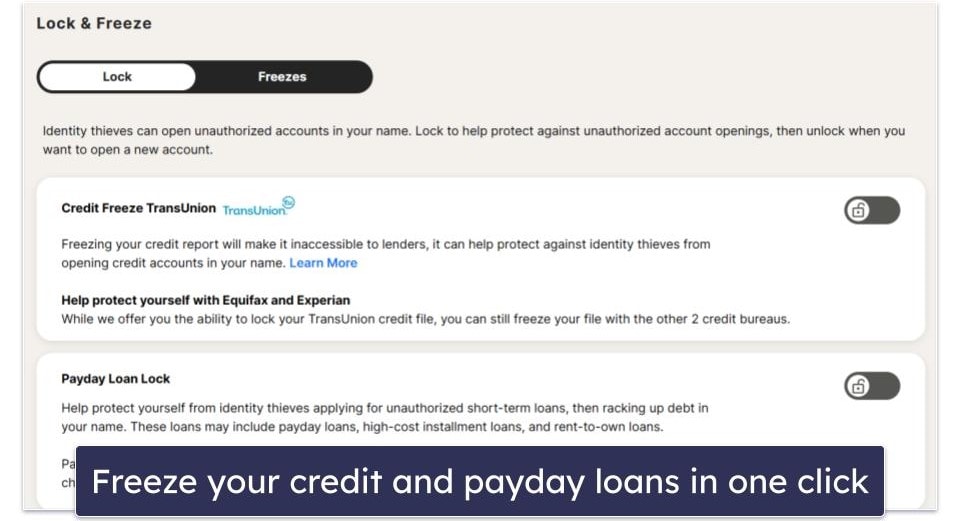

I’m a big fan of the identity-locking feature. With the click of a button, you can instantly freeze your credit score and prevent loans from being taken out in your name. If you think someone is attempting to borrow money using your name, you can respond within a few seconds (just remember that while your credit is frozen, lenders will be unable to pull up your credit score).

LifeLock’s customer support options are excellent, too. Since you’ll need to rely on Norton’s agents in case of identity theft, Norton offers 24/7 live chat and phone support. The agents I contacted were kind and very knowledgeable — my favorite part was that my wait time was less than 5 minutes for phone support.

However, the LifeLock app isn’t perfect. For example, I wish there were more customization options for identity monitoring, but it’s still impressive. You can get LifeLock on PC, Mac, iOS, or Android devices if you live in the US, New Zealand, or Australia. Regardless of which plan you choose, LifeLock comes backed by a risk-free 60-day money-back guarantee, so you can test it out for yourself.

| Coverage | Up to $3,000,000 per adult |

| Identity Monitoring | ✅ |

| Credit Monitoring | ✅ |

| 401K and Investment Account Alerts | ✅ |

| 🎁 Free Plan | ❌ |

| 💵 Pricing | $89.99 / year |

| 💰 Money-Back Guarantee | 60 days |

| 💻 Operating Systems | Windows, Mac, Android, iOS |

Norton LifeLock Full Review — The Best Identity Monitoring Service on the Market in 2024

Norton LifeLock is my favorite identity monitoring service on the market. It provides a comprehensive set of tools that keep a watchful eye over your sensitive information, financial accounts, credit score, 401k account, and a lot more. I particularly like the dark web monitoring tools, which give you immediate alerts if any of your data is found in a breach. Even the cheapest plan offers a ton of monitoring tools and is well worth the cost.

Opting for the Ultimate Plus plan gets you up to $3 million in identity theft coverage and myriad extra tools like social media account monitoring and phone locking. As far as coverage goes, you get up to $1 million in personal expenses, $1 million in legal experts and lawyers, and $1 million in theft reimbursement.

LifeLock plans are available in the United States, New Zealand, and Australia, and all come backed by a generous 60-day money-back guarantee, so you can test it out for yourself and make sure you like it.

Norton LifeLock Plans & Pricing — Affordable Plans With Tons of Value

Norton offers a variety of affordable plans that let you choose the amount of coverage. My two favorite plans are LifeLock Standard and Ultimate Plus. LifeLock Standard is a great plan if you’re looking for entry-level identity monitoring. It provides up to $1 million in coverage and credit monitoring with one bureau. LifeLock Ultimate Plus contains all of LifeLock’s features, offers the full $3 million in coverage, identity monitoring with all three major credit bureaus, and more.

Both Standard and Ultimate Plus are individual plans, but you can add as many adult or junior family members as you wish at checkout, and the first-year discount will apply to them as well. The Ultimate Plus plan for 2 adults is the most cost-effective option since an additional discount is applied to the second license.

LifeLock can currently be purchased in the US, New Zealand, and Australia. Every plan comes backed by a risk-free 60-day money-back guarantee, and Norton makes it very easy to get a refund.

| LifeLock Standard | LifeLock Ultimate Plus | |

| Platforms | PC, Mac, Android, iOS | PC, Mac, Android, iOS |

| Price | $89.99 / year | $239.88 / year |

| Coverage | ✅ (Up to $1,050,000) |

✅ (Up to $3 million) |

| Legal coverage | ✅ | ✅ |

| Stolen funds reimbursement | ✅ | ✅ |

| Personal expense compensation | ✅ | ✅ |

| Dark web monitoring | ✅ | ✅ |

| Social Security alerts | ✅ | ✅ |

| Credit monitoring | ✅ | ✅ |

| Identity lock | ❌ | ✅ |

| Phone takeover monitoring | ❌ | ✅ |

| Financial account alerts | ❌ | ✅ |

| Buy now pay later alerts | ❌ | ✅ |

| 401k & investment activity alerts | ❌ | ✅ |

| Home title monitoring | ❌ | ✅ |

| Social media monitoring | ❌ | ✅ |

LifeLock Standard — Basic Plan With ID Monitoring Tools

LifeLock Standard offers up to $1,050,000 in coverage split between reimbursements for legal experts ($1 million), theft ($25,000), and personal expenses ($25,000). With a subscription price starting at $89.99 / year, it’s well worth the investment in case your identity gets stolen.

It also comes with a set of basic (but effective) identity monitoring tools, including:

- Dark web monitoring.

- Data breach notification.

- Stolen wallet monitoring.

- One-bureau credit monitoring.

- 24/7 live chat support.

LifeLock’s entry-level plan doesn’t come with a ton of identity monitoring features, but each of them works very well, especially the dark web monitoring.

While it’s affordable, it doesn’t have many of the advanced features that the higher-tier plan comes with, like 401k and investment account alerts, identity lock features, home title monitoring, or social media monitoring.

LifeLock Ultimate Plus — Premium Plan With Additional Coverage

LifeLock Ultimate Plus offers the most value by far. For $239.88 / year, you get everything included in the previous plan, plus:

- 401k and investment alerts.

- “Buy now, pay later” alerts.

- Social media monitoring.

- Home title monitoring

- 3-bureau credit monitoring.

LifeLock Ultimate Plus offers more than twice the amount of reimbursement as LifeLock Standard. This includes:

- Up to $1 million in identity theft reimbursement.

- Up to $1 million in personal expense reimbursement.

- Up to $1 million in law and legal expert fees.

LifeLock Ultimate Plus for 2 adults begins at $395.88 / year. Every subsequent license you want to add will cost you an additional fee, which can be quite pricey.

Norton LifeLock Security Features — Wide Range of Features to Protect Your Identity

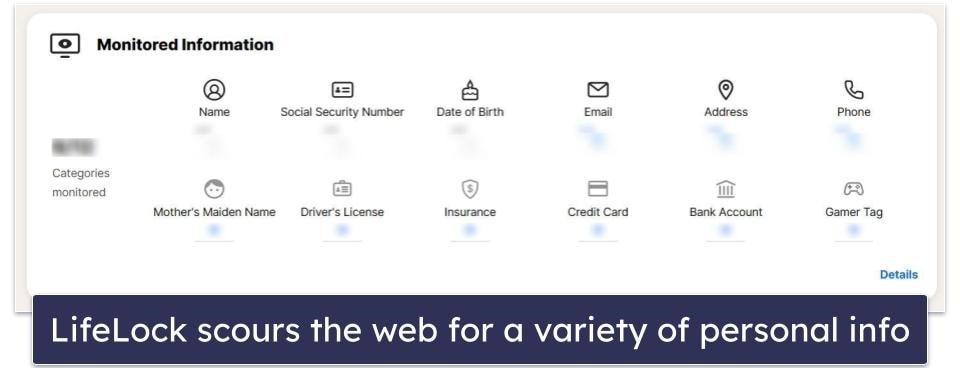

Identity Monitoring — Scans for Data Breaches Involving All Kinds of Sensitive Data

Norton’s identity monitoring tools are easily the best I’ve tested. LifeLock constantly scans the dark web, looking for any of your personal information that may have been leaked during a data breach or posted in a seedy underground forum.

When you first make your account, you’ll enter some basic information for LifeLock to protect, including your phone number, address, and social security number. After that’s done, you can head to the “Monitored Information” tab and add even more sensitive information. This includes insurance cards, credit and debit cards, banking information, and even your mother’s maiden name. If any of it is detected on the dark web, Norton will warn you immediately and provide instructions on what you should do next.

The only drawback is that you can’t enter unlimited information. You can only protect up to 5 pieces of information per field, meaning you can store up to 5 credit cards, up to 5 phone numbers, and so on. I’d like to see that expanded on so that the shopaholics out there can protect all of their cards and gamers with multiple accounts can monitor all of them with ease.

However, even with that one drawback, LifeLock monitors more sensitive data than any other identity-monitoring service I’ve tried (including Aura and Bitdefender).

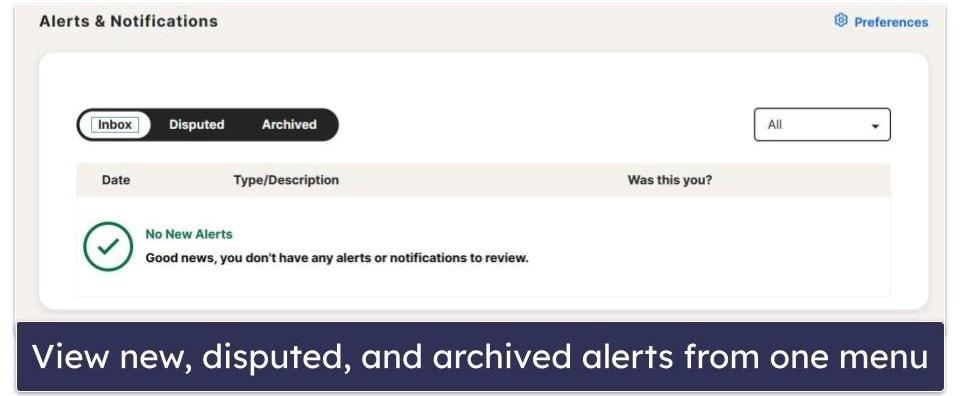

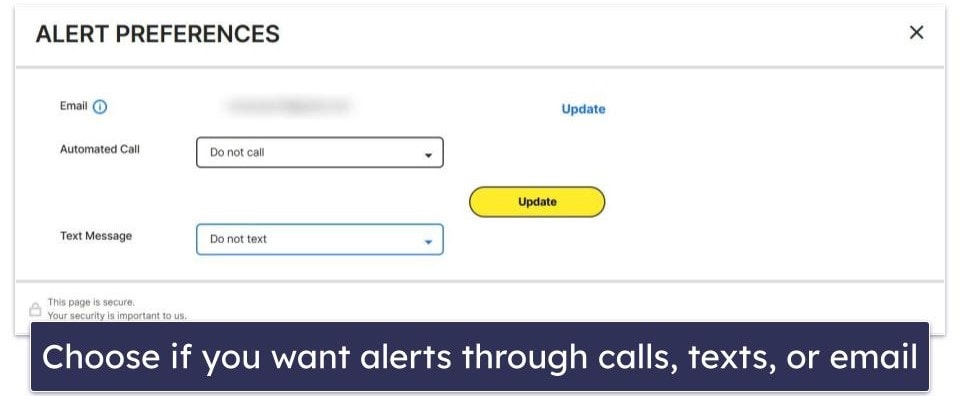

Alerts — Get Instant Alerts About Data Leaks (Tweak to Your Preferences)

Whenever Norton detects any suspicious activity, you’ll immediately get an alert. It will show you any activity it picked up during its dark web scans and provide you with tools to fix the problem (such as account freezing while you rotate your credentials).

You can also easily tweak your alert preferences. For example, you can set LifeLock to never call you and simply send emails instead. I love this freedom — especially if you’re someone who doesn’t like receiving phone calls, but I do appreciate that phone calls are included. Aura is only able to send alerts via text message or email.

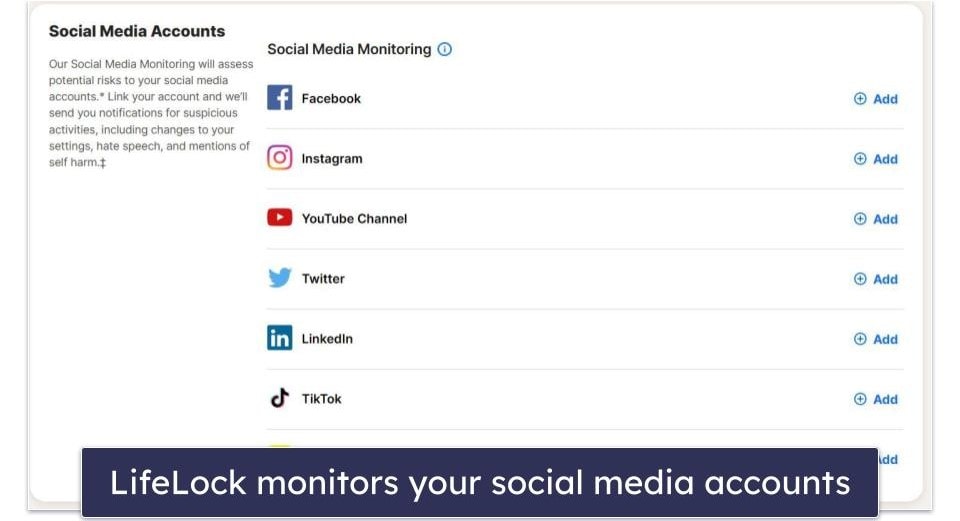

Social Media Monitoring — Get Alerts About Risks Involving Your Social Media Accounts

Alongside personal information, LifeLock meticulously watches your social media accounts. Simply select which social media app you want to monitor and enter your account information. If the login credentials appear anywhere, you’ll immediately be notified. You’ll also be alerted if someone is spreading harmful messages (like hate speech) using your account.

It’s extremely simple to set up but lacks any customization options — which is a bit disappointing. I’d like to see a way to choose what type of speech is monitored (similar to how you can in parental controls tools like Bark), but besides that one nitpick, it’s the best social media monitoring tool that I’ve tested. I’d highly recommend social media monitoring if you upload any content to sites like YouTube or TikTok since hackers are constantly trying to steal popular creators’ accounts.

Identity Lock — Prevent Unauthorized Account Openings

Norton LifeLock allows you to lock your credit score to prevent threat actors from opening accounts in your name. Locking your credit score will also prevent any lenders from pulling up your score, so you should be careful using it. Identity lock is remarkably easy to use; you can completely freeze your identity with just a few clicks.

You can also use the payday loan locking feature, which prevents any cash advances or loans from being taken out in your name. If you suspect a criminal is attempting to take money out in your name, you can freeze your credit score and lock all loans within a few seconds of getting the alert.

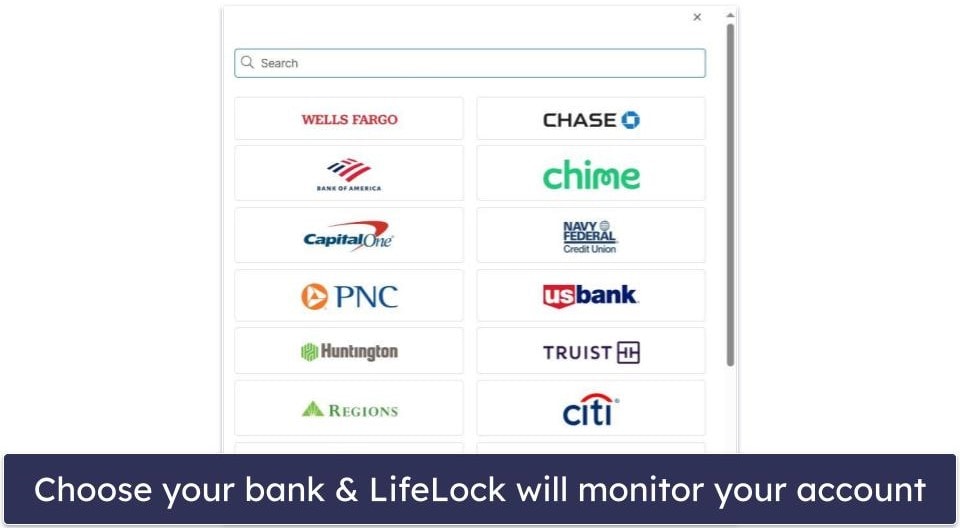

Financial Monitoring — Recieve Alerts About Suspicious Bank Activities

LifeLock also specializes in monitoring your bank accounts and financial information. All you have to do is choose your bank from the list and enter your account information. After you set it up, Norton will begin sending you alerts any time there’s anything suspicious happening with your bank, 401k, and investment accounts. It also scans for loans and “buy now, pay later” charges made with any of your accounts.

Besides setting up alerts, you can also view your transaction history and your current balance on the LifeLock website (or app). This means you can double-check any transactions at the same time you’re viewing the alert. However, I noticed that it wasn’t as fast at updating transactions as my bank account was — but it’s still helpful.

Financial Reimbursements — Up to $3 Million in Coverage

Last but not least is a collection of financial reimbursements that can minimize the cost of identity theft. The amount you’re reimbursed depends on what plan you pick, but each plan contains at least some reimbursement for each issue.

The 3 reimbursements LifeLock offers are:

- Law and legal expert reimbursements. All 3 LifeLock plans give you up to $1 million for law and legal experts.

- Personal expenses. LifeLock Standard gives you up to $25,000 in personal expense reimbursement after your identity is stolen. Upgrading to LifeLock Ultimate Plus gets you up to $1 million in personal expenses.

- Stolen funds. If you use the entry-level Standard plan, you get up to $25,000 in reimbursement for stolen funds. If you pick up the Ultimate Plus plan, that goes up to $1 million.

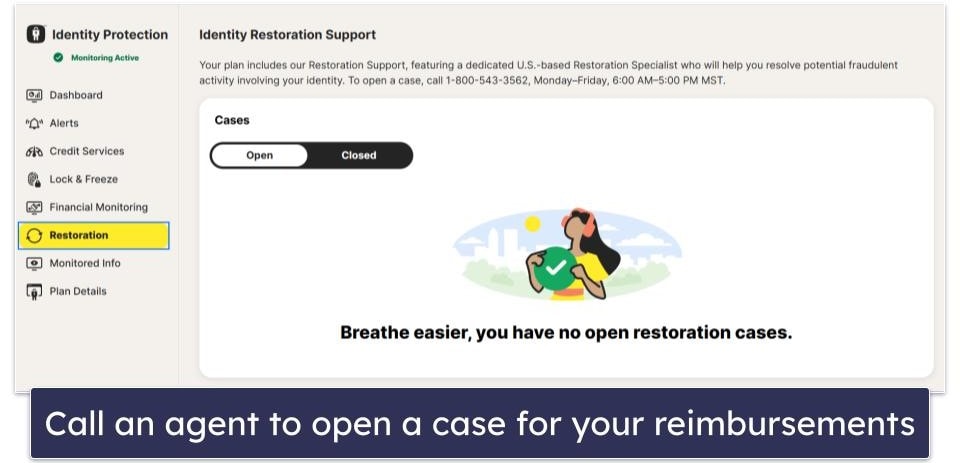

In the event of identity theft, to open a case and begin an investigation, you need to call a specialist using the number found in the Restoration tab of the dashboard. You’ll work with an expert who will take your information and begin figuring out exactly what happened. You can view your open and closed cases on the same Restoration tab.

Overall, though, the reimbursement amounts are excellent. Both Bitdefender and McAfee’s top-tier plans only provide $2 million in identity theft coverage, while Aura’s top-tier plan provides $5 million in coverage (but is more expensive). I think Norton sits nicely in the middle and provides excellent value for money.

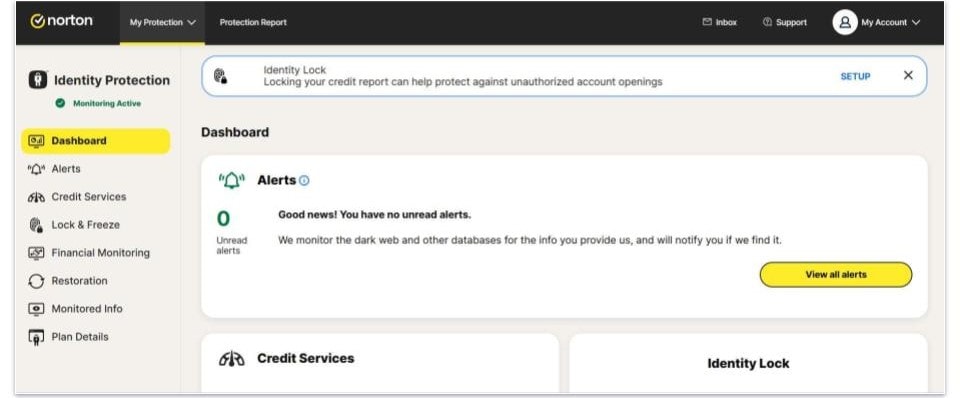

Norton LifeLock Ease of Use & Setup — Simple, Browser-Based Management

Installing Norton LifeLock on your computer couldn’t be easier — you don’t have to do it! All of LifeLock’s features are managed right from your browser. All you have to do is log into your Norton account and go to your dashboard, and voila, you’re finished.

How to Install Norton LifeLock (Just 3 Simple Steps):

- Purchase a Norton LifeLock subscription. Head to the official Norton LifeLock website and choose the subscription you want. Enter your payment details, confirm your purchase, and move onto step 2.

- Log into the Norton dashboard. After grabbing your subscription, navigate to your Norton account and log into the dashboard.

- Follow the instructions. Once you’ve logged into the dashboard, follow the instructions to add personal information you want to monitor.

The first time you use LifeLock, you’ll have to enter some personal information, like your name, address, and Social Security number. Once you’ve finished the basic steps, you can easily enter additional information you want monitored.

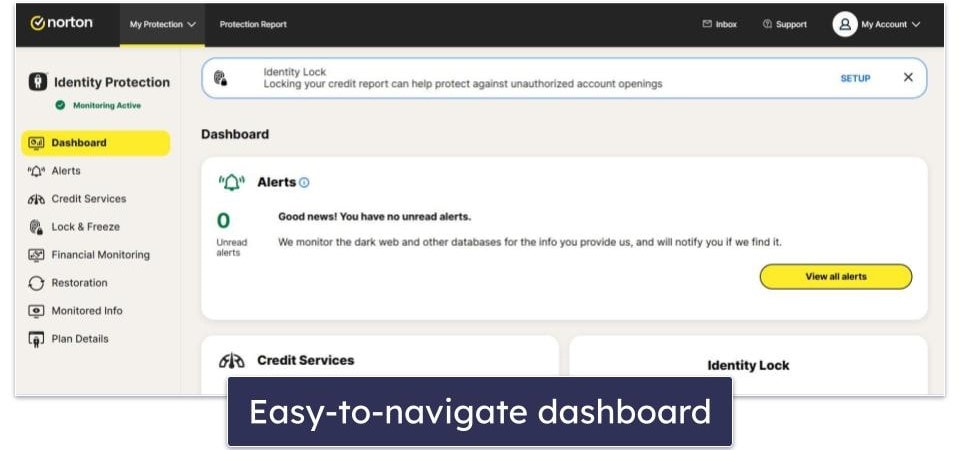

The user interface is highly intuitive — information is sectioned off and presented neatly, and features are very easy to find. I like how you can access everything from the menu on the left side of the screen, and the buttons on Norton’s dashboard are clear and easy to see.

It’s also really easy to see important information like your credit score and to access features such as the identity lock and restoration pages. Honestly, I never had a difficult time navigating Norton’s identity protection dashboard or accessing any features. It’s easy to install, highly intuitive, and quick to get around.

Norton LifeLock Mobile App — Intuitive Mobile Apps (Similar to the Web-Based Dashboard)

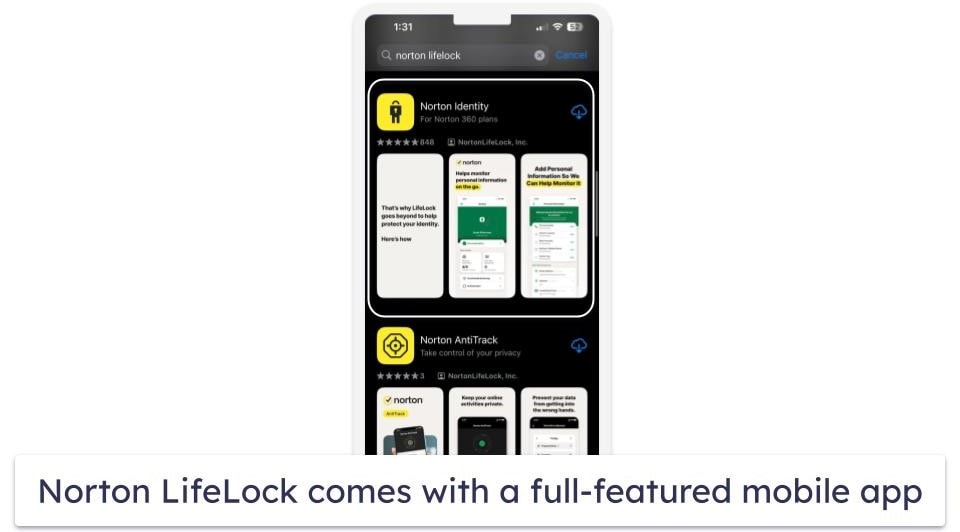

LifeLock’s mobile apps are just as easy to use and fully featured as the PC versions. However, unlike the PC versions, you need to install an app, but that’s as easy as opening up your phone’s respective app store and tapping the Download button.

One thing I like a lot about the mobile apps is how much they look like the computer version. That may sound like a tiny detail, but when you’re constantly moving between your phone and computer, it’s nice to have a similar layout so that everything is right where you expect it.

On top of that, neither the Android nor iOS versions have any restrictions like some mobile products do. Both include every feature the desktop versions have. This includes up to $3 million in identity theft coverage, dark web monitoring, 401k and investment account alerts, and more.

The mobile app also blocks screenshots. This shows how secure it is against hackers, but it also means I wasn’t able to take screenshots with my phone while writing this review.

Overall, Norton LifeLock’s mobile app is intuitive, easy to use, and lets you access every feature on the go. Since it doesn’t lack any features found in the desktop version, I think it’s a lot more convenient to install the app on your phone instead of using the desktop browser (but that’s just because I’ve been addicted to my phone since 2010).

Norton Customer Support — Excellent 24/7 Customer Support & FAQs

Norton LifeLock offers an impressive range of customer support options, including 24/7 live chat, phone support, and a detailed FAQ section. I also like that support options are available in dozens of languages, including English, French, and Chinese.

My favorite way of getting in touch with the agents is the 24/7 live chat support. I asked a few questions, once in the middle of the day and once at night. Both times, I was connected to an agent within a few minutes. Both were professional and knowledgeable, answering each question I had with a surprising amount of detail.

The 24/7 phone chat support is pretty good, too. I waited less than 5 minutes for an agent (meanwhile, my bank puts me on hold for hours), and they were just as helpful as the live chat representative was. If you prefer getting help from a human over vague automated answers, I’d highly recommend Norton.

You’ll need to give them a call to open up a case. However, the phone line for making a case is only open Monday–Friday, 6am–5pm, so plan accordingly.

There is also an FAQ section with answers to dozens of general questions. Various Norton products are separated into tabs, so it’s pretty easy to find questions related to LifeLock. The layout is a bit disorganized, though, so I’d recommend using the search bar to find what you’re looking for quickly.

Norton also has an active community forum, but it doesn’t include a thread for LifeLock products. There are sections for the antivirus, the password manager, the parental controls, and the mobile versions of each app, but there’s no forum dedicated to LifeLock which is a shame.

Overall, Norton LifeLock’s customer support is excellent. The 24/7 chat and phone support is available in dozens of languages and has responsive and knowledgeable agents. My biggest complaint is the lack of a dedicated section for LifeLock in the forums, but that’s not such a big deal to overshadow how great the rest of the options are.

Will Norton LifeLock Protect Your Identity?

Absolutely. Norton LifeLock offers the most advanced identity monitoring tools I’ve tested, along with coverage of up to $3 million for legal experts, personal expenses, and more. All of these features provide comprehensive identity protection.

By monitoring your personal information, financial accounts and information, credit score, and the dark web for any leaked data, LifeLock completely protects your identity. You’ll begin getting alerts the moment Norton detects anything suspicious going on with any of your information, from a sudden address change to a loan being taken out in your name.

The $3 million in coverage is a lot more than most of its competitors offer, making it an investment that’s well worth the value proposition.

The user interface for LifeLock is intuitive and easy to navigate. Whether it’s the Android, iOS, Windows, or Mac version, you’ll have no problem viewing your alerts, entering new information to monitor, or claiming your reimbursements.

I like the customer support options, but there are a few improvements I’d make if I could. I’d like to see a dedicated place on the forum for LifeLock questions and an improved UI for the support options in general, but the responsive 24/7 live chat and phone support more than make up for it.

Overall, Norton LifeLock is my favorite identity monitoring service. It’s fully-featured, intuitive, and offers a wide range of monitoring options and types of coverage. Even if there are a few areas I’d like to see some improvement in, LifeLock offers a ton of value. Since it comes with a 60-day money-back guarantee, you can make sure it works for you before sticking with it.

Frequently Asked Questions

What does LifeLock do?

Norton LifeLock is a comprehensive identity monitoring service that scans the dark web for your information, keeps watch over financial information like bank account activity or sudden changes in your credit score, and alerts you whenever it detects any suspicious activity with your credentials.

LifeLock also offers fairly generous coverage in case your identity is stolen. The top plan offers $1 million for law and legal experts, $1 million in stolen funds reimbursement, and $1 million in personal expense funds for a total of $3 million in coverage.

You can either get LifeLock as a standalone subscription or as an add-on to Norton’s award-winning antivirus.

Is LifeLock free?

No, LifeLock isn’t free. While Norton does offer a few free tools, like a free browser extension and a website scanner, LifeLock is a premium identity monitoring service (and a pretty affordable one). That said, since Norton comes with a 60-day money-back guarantee, you have plenty of time to see if it works for you before committing to a plan.

What platforms can I use with LifeLock?

Norton LifeLock supports Windows, Mac, Android, and iOS devices. Unlike Norton’s antivirus, which has limited features on iOS and Mac, each of these apps offers the same identity monitoring features. Whether you’re on iOS, Android, or Windows, you’ll have the same level of identity monitoring and amount of coverage.

Which is the best LifeLock plan?

The answer depends on what you need. For example, if you’re looking for a good entry-level identity monitoring plan, you can’t go wrong with LifeLock Standard. That said, I think LifeLock Ultimate Plus is the best overall plan.

It comes with up to $3 million in coverage (a big leap over the Standard plan’s $1 million) and a slew of features like credit monitoring, 401K and investment account monitoring, and much more. You can pick up a plan for an individual and add as many licenses as you want (for an additional fee per user) and take advantage of the 60-day money-back guarantee to make sure it works for you.